Tariffs and the Tax Bill Roil Interest Rates

What is Up With The Bond Market, the Value of the Dollar, and Mortgages

President Trump’s schizo pronouncements on tariffs (taxes on imported goods and services) have injected a lot of volatility into the stock and bond markets. Since goods will become more expensive, there will likely be less trade. Additionally, given the abominable treatment of some foreigners living (illegally and legally) in the US, and horror stories of perfectly legitimate foreign visitors being detained (for no good reason) upon entry into the US, foreign tourism and entry of foreign students will result in losses to the US of tens of billions of dollars - already. The value of the US dollar has fallen by at least 5% against most major currencies since Trump’s “Liberation Day” speech/charade of April 2, 2025.

In an unusual move, long-term US Treasury interest rates have risen while the value of the dollar has fallen in the past 2 months. This is not a vote of confidence in the USA, or our economic prospects. The 30-year US Treasury bond was yielding (paying) about 4.33% before the tariffs were announced. They are now 4.86%, were up over 5% in late May. It might not sound like much but it costs the US 10% more to borrow long term. That is not good. The chart below shows the interest rate (yield) on ten year US treasury bonds. As you can see they have been much higher, particularly coming out of the 1970s-80s inflation. (The grey areas represent recessions.) The Federal Reserve took active steps to push rates down starting around 2008, but the Fed stopped once inflation kicked in around Covid inflation. Most people don’t have any perspective about what high interest rates or high inflation are actually like. We’ve had low US interest rates, relatively speaking, almost all of the 21st century. Rates started to rise after 2020 (inflation and interest rates usually go up together). Some rates, like mortgage rates, have risen faster than others (more on this later.) Still, 6.75 or 7% mortgage rates are not so unusual. Unfortunately, both the tariff policies proposed by Trump and the spending priorities of the Congress guarantee that future generations will face higher rates far into the future. The bill recently out of the House of Representatives is estimated to cost close to $3 trillion in debt borrowings over the next 10 years.

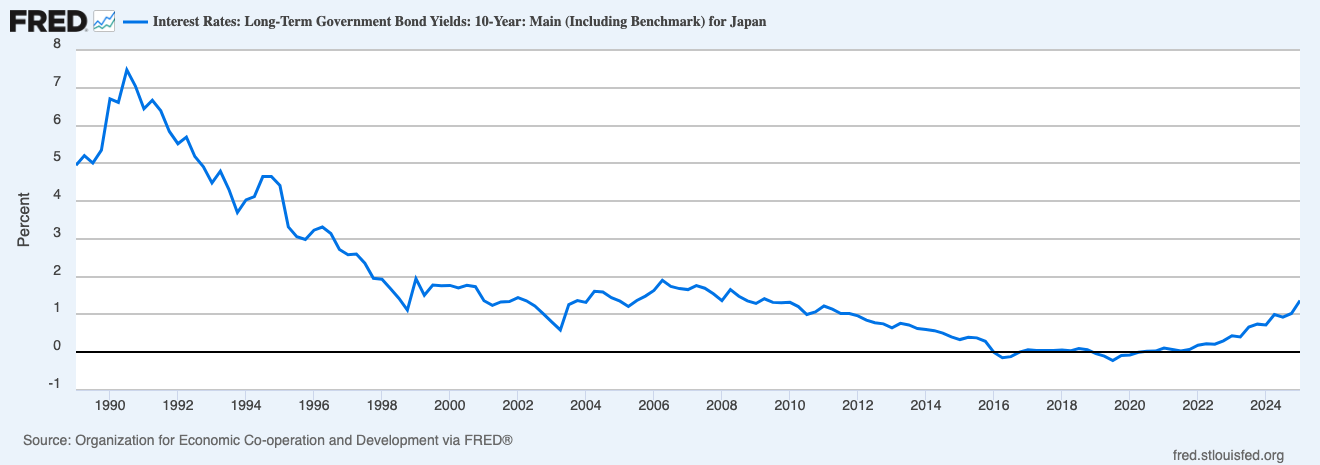

Let’s compare the US to Japan. The timing on this chart below is not the same as the previous but it shows the yield on 10-year Japanese Government Bonds, which appear shockingly low. Japan is a country whose debt/GDP ratio is 200%, higher than the US ratio which is over 100% (our federal debt is larger than our nominal GDP). Japan has been, historically a country of savers, with many families saving 40% of their income. They put money into the bank or in bonds (and stocks). Japan had negative yields from about 2016 to 2021. The Bank of Japan was buying every bond in sight.

Since Covid, and inflation, Japanese rates have started to rise. In fact Japan also sells 30 and 40 year government bonds (the chart is only of 10 year bonds). Some Japanese have 40 year mortgages. Japan is a well-off country but faces many challenges. The population is getting old fast (not quite as bad a China). But the old people will spend down their savings. Houses are not built to last that long there, there are not a lot of 100+ or 200 year old residences, even though the civilization is old. Japan will need capital. Ever since Trump foolishly set off this trade war, bond yields have gone up. Recently the yield on 40-year Japanese bonds went up to a record 3.675%. They will have to compete with the rest of the world for money. Personally I would not buy a 10, 20, 30 or 40 year bond from any developed government. They simply do not pay enough interest, given the risk. Apropos of nothing, I want to mention the so-called Three Chinese Curses:

May you live in interesting times;

May you attract the recognition of our rulers; and

May you get what you are looking for.

Our Weird Housing Market

Well, the chart below shows that we live in “interesting times” in the housing market.

Supposedly, there are 500,000 more home sellers than buyers. The sellers are mostly older, have paid off houses, or have 3 or 4% mortgages, and want to sell their homes for a lot of money, ridiculous amounts of money in some cases. The buyers, those who are not so discouraged, need some downpayment, need income to qualify for maybe a $500,000 or more mortgage at around 7%. Now, ordinarily economics tells us that the prices should go down. But people want money, and many older people want to stay in their house as long as they can. (Only the later is a new trend, people have always been greedy.) Now I’m not here to bash older homeowners. There are other things happening. Housings starts this spring were about as slow as they’ve been since the “great financial crisis” so-called of 2009. There are many reasons for this, among them that we import lumber and products made out of steel and aluminum into housing, and our brilliant Negotiator-in-chief has not seen clear to figure out what tariffs will be on many of these things. So the housing market could be weird for some time.

We are also deporting people from the US who used to work construction, or they are self-deporting, and we seem intent - if Congress’s budget bill is any indication - of making America a worse place to live for people who need Medicaid, food stamps, etc. It is almost callous to think about whether an older person sells their house for $600K versus $800K when we have families with children who soon might have no healthcare or enough food. Well, I am not going to talk about global warming in this release, but it is supposed to be an awfully hot summer in the USA. Stay Strong and Drink Water.